Harvard University: Hefty Tuition with Healthy Financial Aid?

Checking the reality against the rhetoric.

Introduction

People, including HODP, often scrutinize tuition at top universities. But it’s important to dovetail any discussions of tuition with analysis of financial aid to see to see if Harvard really lives up to its promise to “bring the best students to Harvard, regardless of their ability to pay.”

Harvard’s tuition ranks as one of the highest in the U.S. The 2019–2020 Harvard College tuition was $47,730. Tuition, room, board, and fees combined were $68,401.

However, fifty-five percent of full-time undergraduates receive some kind of need-based financial aid, and the average need-based scholarship or grant award is $55,678.

Given these contrasting realities, we wanted to further investigate how Harvard’s financial aid actually works. In particular, we took a look at which schools within Harvard had the most financial aid, where exactly this aid was coming from, and how aid per student changed over time.

Gathering our Data

We used the HODP catalog, which contains data on Degree Student Financial Assistance from the Office of Institutional Research. We used a PDF converter to transfer the data to Excel, and we used Jupyter Notebook and Excel to create our visualizations.

Aid by School

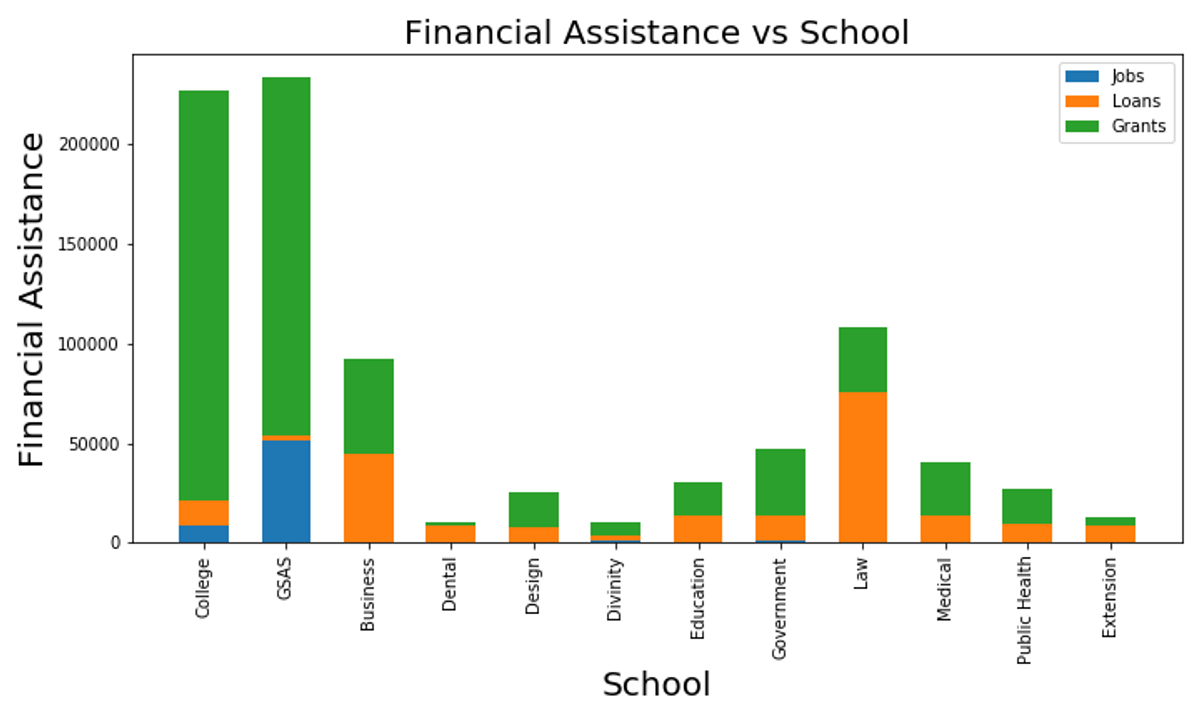

First, we broke down 2018 financial aid data by the school that awarded it, among the College and Harvard’s graduate schools. As pictured in Figure 1, the Graduate School of Arts and Sciences (GSAS) receives the greatest amount of total financial aid, followed closely by Harvard College, and then the Law School. The first graph depicts the total sum of money received by all students, broken down into loans, grants, and job income.

Figure 1: Total amount of financial assistance by type and by Harvard school.

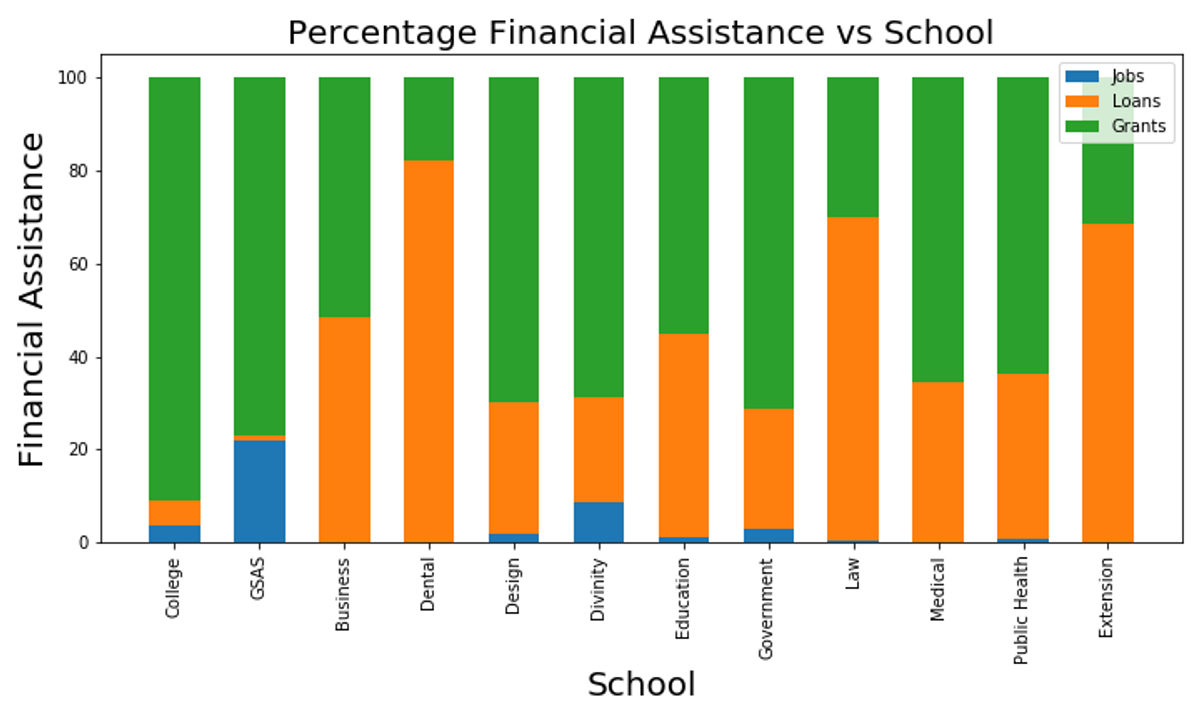

Figure 1: Total amount of financial assistance by type and by Harvard school.Figure 2 uses the same data but depicts the proportion of each type of financial assistance by school. We can see that for most of the schools, almost all of the financial aid comes in the form of loans and grants, with few exceptions for jobs, mostly among GSAS students. Financial aid eligibility is determined by the information provided in the student’s Free Application for Federal Student Aid (FAFSA). Grant money never has to be repaid, loans can be either student or parental, and job financial aid comes in the form of student employment by Harvard.

Figure 2: Proportions of financial assistance by type and by Harvard school.

Figure 2: Proportions of financial assistance by type and by Harvard school.Something that stood out to us in these graphs is the amount of financial aid coming from the Law School in the form of loans. This is particularly interesting because the enrollment isn’t substantially higher in comparison to the other larger graduate schools, and neither is the cost of attendance, yet the amount of loans is substantially greater. The Dental and Extension Schools also have high proportions of loans but lower total loan amounts.

The Business School has the next-largest amount of loans. Job financial aid seems to be a relatively small portion of financial aid aside from at GSAS, where job income accounts for 20% of student assistance. In summary, grants and loans play a very large role in Harvard’s financial aid, with the former being very significant in the College and GSAS and the latter playing a substantial role in all the graduate schools other than GSAS.

Types of Grants

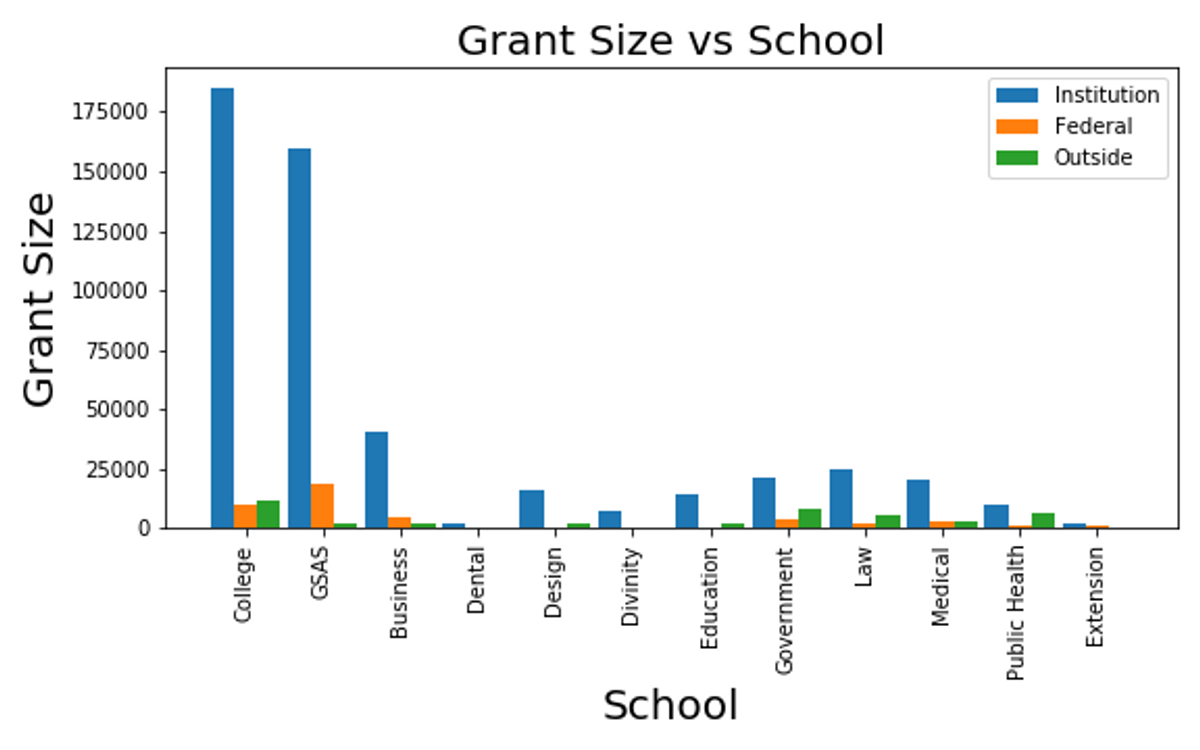

Figure 3: Sources of aid by school.

Figure 3: Sources of aid by school.In each of the three categories of jobs, loans, and grants, aid can be broken down further into three sources: Institution, Federal, and Outside. Institutional financial aid comes directly from Harvard, and federal aid may come in the form of a Federal Pell Grant of a Supplemental Educational Opportunity Grant (SEOG). Outside financial aid may include scholarship funds from sources such as secondary schools, civic organizations, students’ parental employers, corporations, the National Merit Scholarship Programs, the G.I. Bill, and the ROTC. Figure 3 above shows the sizes of various sources of grant aid by school.

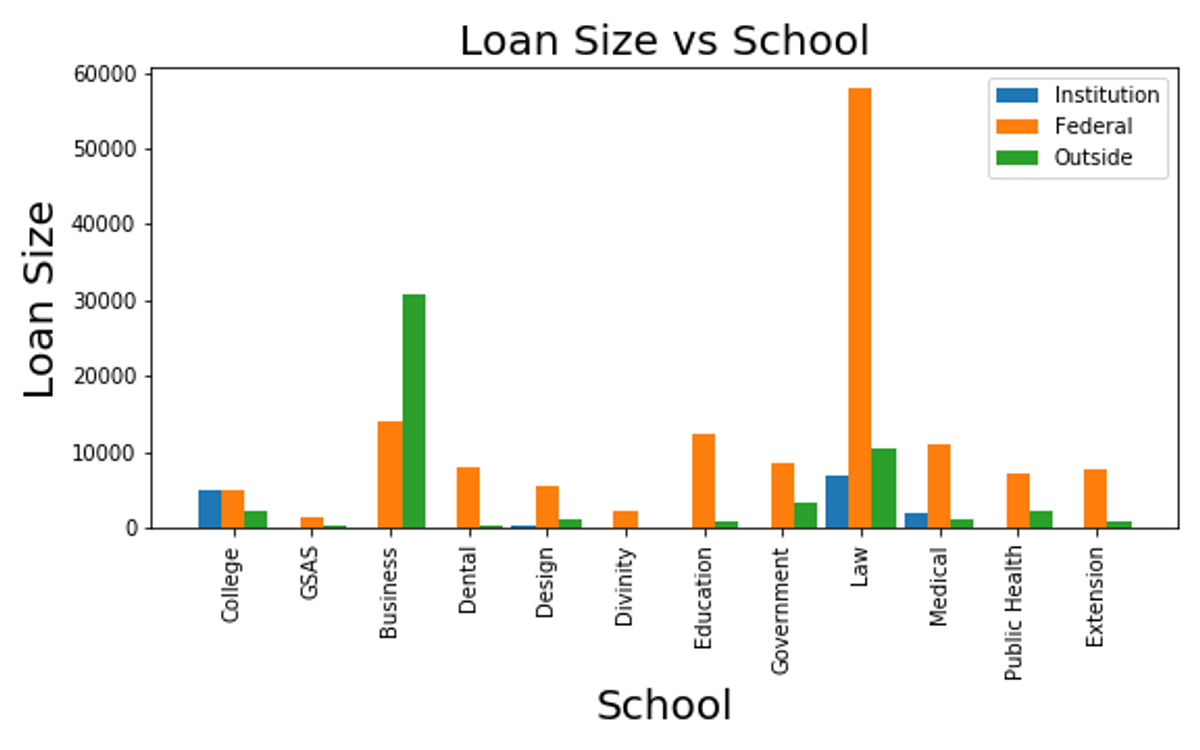

Figure 4: Sizes and sources of loans by Harvard school.

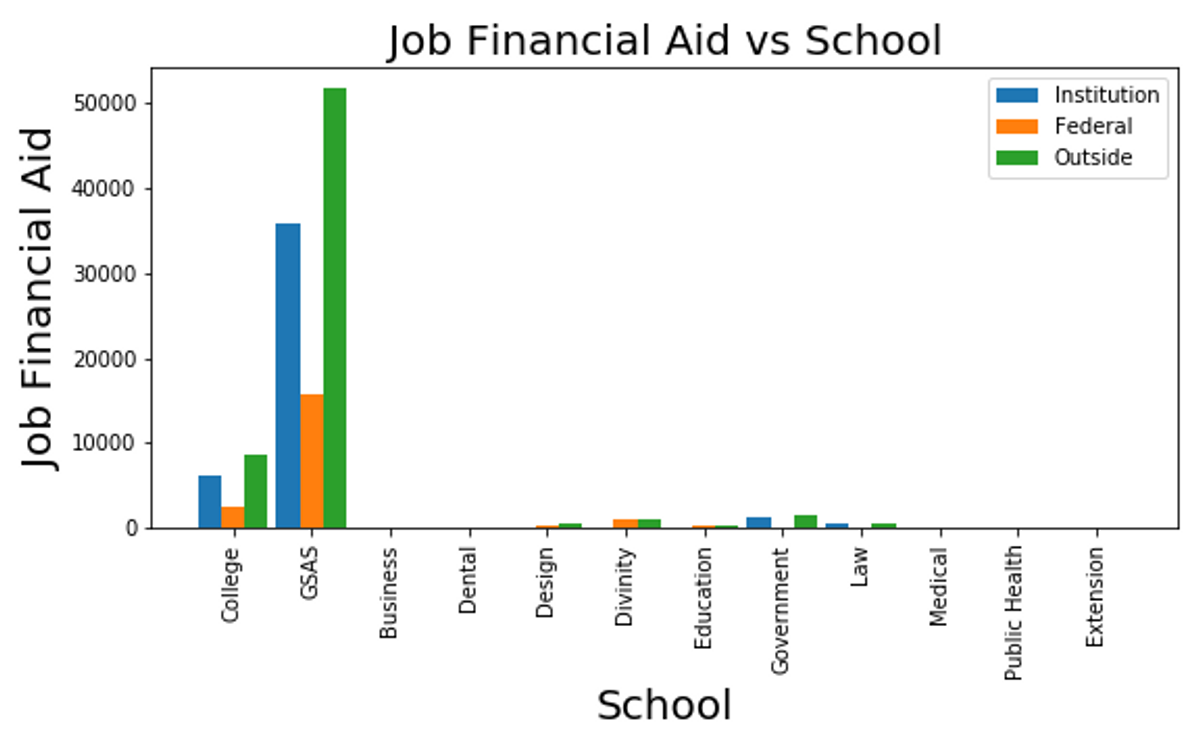

Figure 4: Sizes and sources of loans by Harvard school.Figure 4 above shows us the sizes and sources of loans specifically. We can see that most loans to Harvard students are federally funded, and that a plurality are given to Law School students. Business school students receive more outside loans than do most other students. Finally, as seen in Figure 5 below, job financial aid seems to be the most spread out between the three sources of institution, federal, and outside job financial aid is most relevant in GSAS and the College.

Figure 5: Sources of job financial assistance by school.

Figure 5: Sources of job financial assistance by school.Trends Over Time

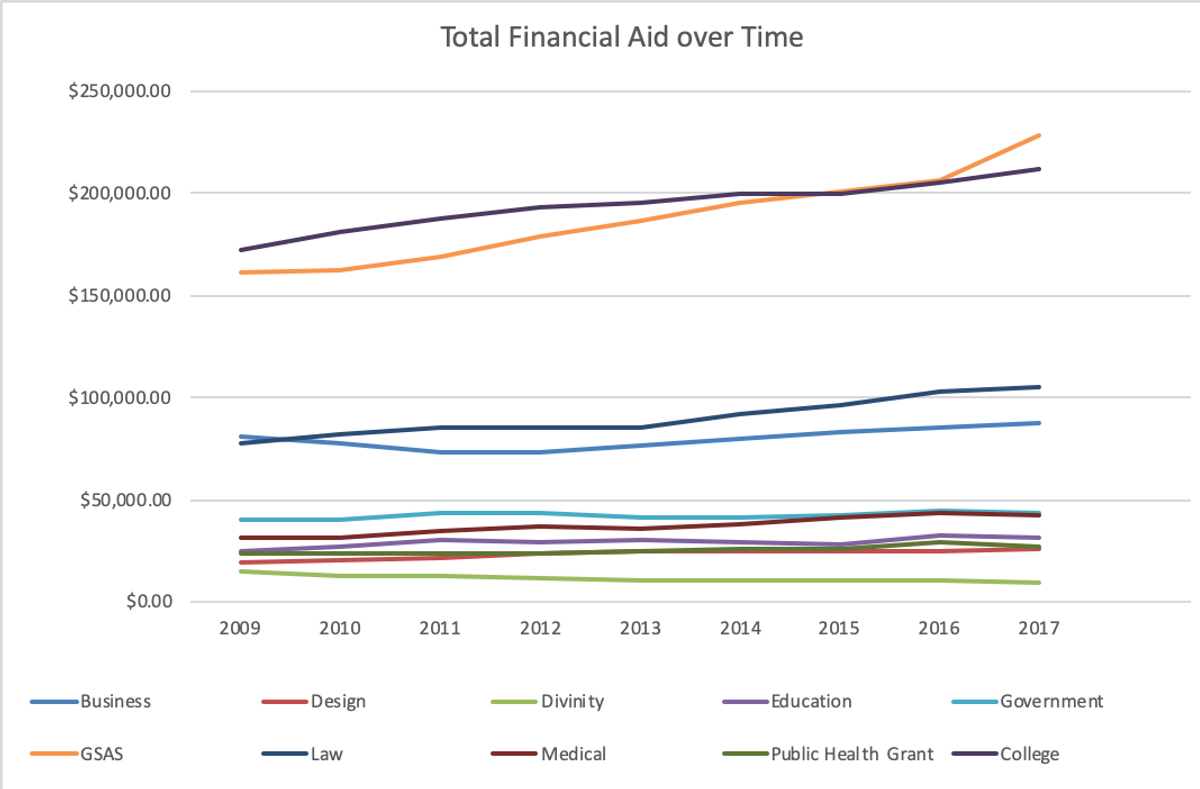

The Harvard OIR keeps public records of financial aid by school going back to 2009, so we visualized their historical data to look for trends over time. It is important to recognize that this data is not inflation-adjusted. That being said, Figure 6 tracks changes to the total sum of financial aid given to each school. We then found historical data for enrollments and tuition (not including room and board) at Harvard’s various schools.

Figure 6: Total financial aid over time by school (not inflation-adjusted).

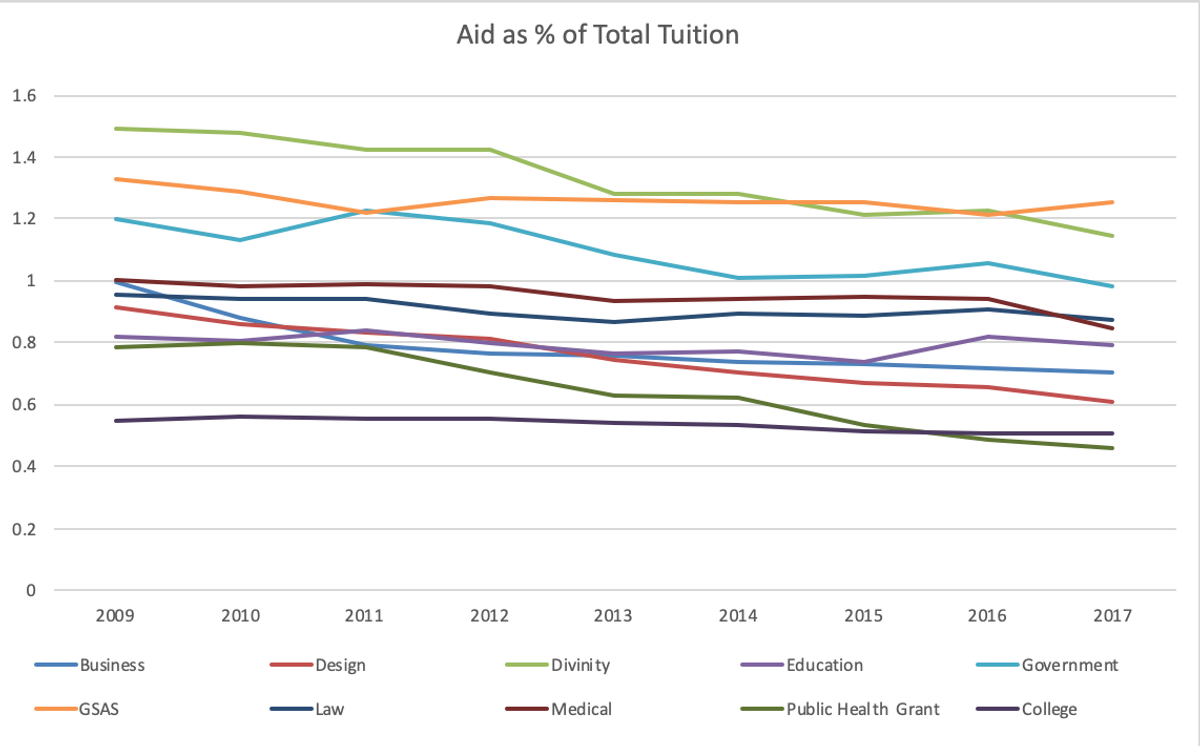

Figure 6: Total financial aid over time by school (not inflation-adjusted).Figure 7 depicts changes over time to the average financial aid as a percentage of total tuition. This graph gives a better sense of the “real financial aid” being given by comparing it to the cost of attendance.

Figure 7: Financial aid as a percentage of total tuition over time, by school.

Figure 7: Financial aid as a percentage of total tuition over time, by school.Notably, some of the percentages are larger than 100% because financial aid also contributes to room and board and other fees.

The Crimson reported that GSAS’s professional stipends have increased by 3% every year for the last six years, which puts Harvard on par with peer institutions for financial aid to grad students. However, our data suggests that, in comparison with tuition, GSAS aid fell by 8% from 2009 to 2017, as rents in Cambridge rose. Meanwhile, the decrease was least severe at the College; it fell precipitously (by more than 30%) at some of the smaller professional schools, including Divinity, Design, and Public Health.

Concluding Remarks

Our goal was to explore Harvard’s financial aid data to find interesting trends. We were interested in the breakdown of financial aid into grants, loans, and jobs, and we also looked at the further breakdown into institution, federal, and outside.

In addition, GSAS and law school students receive the most financial assistance per student. Something that we’d like to explore further is why such a large proportion of financial aid for the Law School comes from loans.

We also observed that most grant financial aid comes from the institution, a large majority of loan financial aid is federal, and job financial aid is a much more heterogeneous mix of institution, federal, and outside sources.

Next, we looked at how financial aid data evolves over time. An important key takeaway is that many of the total sums of financial aid given to each school is increasing, while the aid as a percentage of total tuition is decreasing across almost all the schools. We wanted to take a look at this data because we found it personally relevant, particularly in light of last semester’s graduate student union strike, and because we wanted to see how much Harvard delivers on its promises of financial aid.